The rise of digital assets, like cryptocurrency and NFTs, has reshaped how people invest and transfer money. But as this space grows, so does the need for clear tax rules. That’s where Form 1099-DA comes in.

This new form, introduced by the IRS, is set to bring structure and accountability to how digital asset sales are reported. Whether you’re a trader, investor, or broker, here’s what you need to know.

What Is Form 1099-DA?

Form 1099-DA is a tax form used to report proceeds from digital asset sales or exchanges. It functions much like Form 1099-B, which reports traditional securities transactions.

The IRS created this form to make sure digital asset transactions, like selling crypto or NFTs, are properly documented and taxed.

Who Should Pay Attention?

This form mostly affects brokers, including digital asset exchanges, who help customers buy or sell crypto and similar assets.

If you’ve ever used a platform to trade Bitcoin, Ethereum, or NFTs, chances are that platform will eventually send you a 1099-DA.

Important date: Reporting requirements officially kick in for transactions completed on or after January 1, 2026.

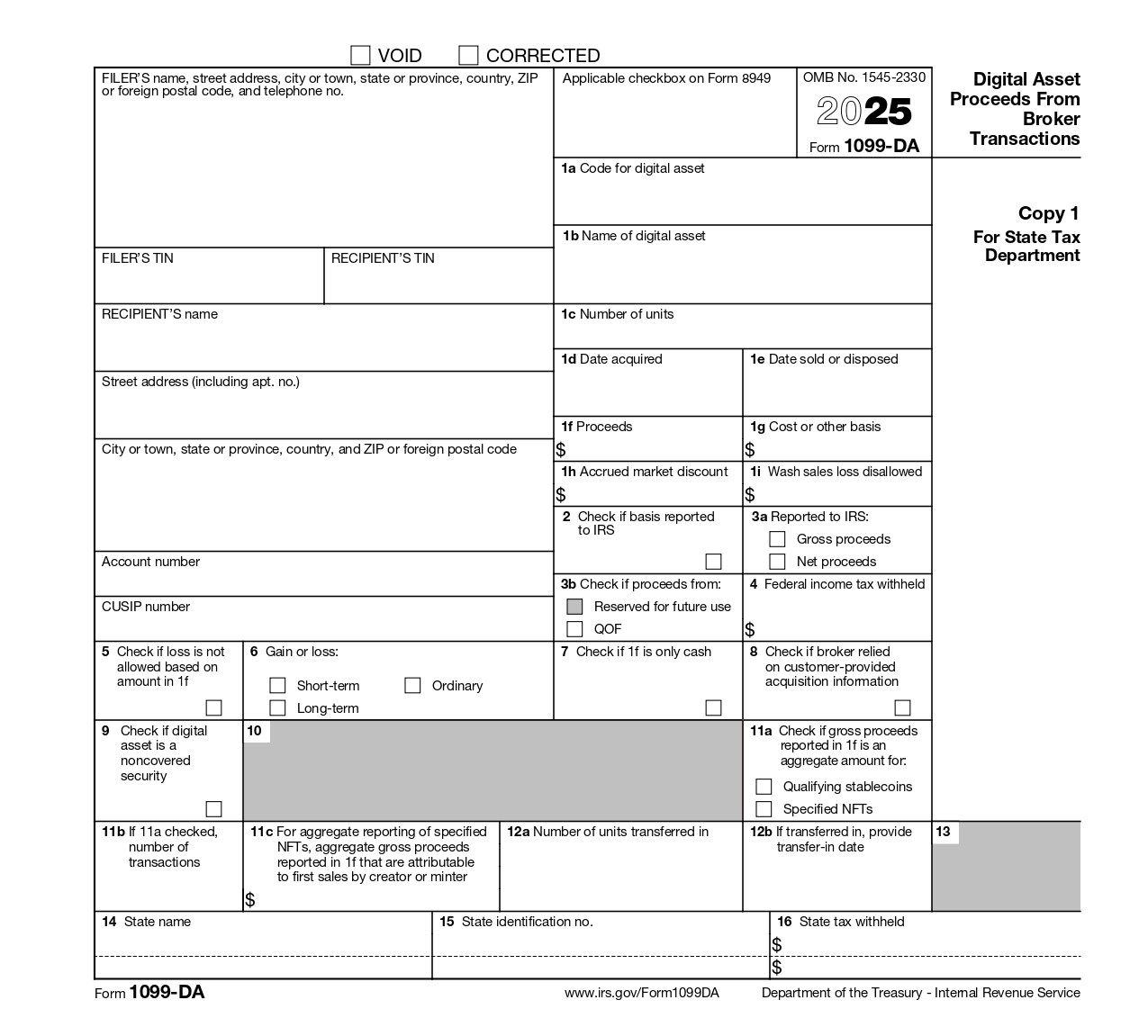

What Will Be Included on Form 1099-DA?

When you receive this form, it will likely include the following details:

- Gross Proceeds – The total amount received from selling your digital asset(s).

- Asset Identifiers – The name and code of the asset sold (e.g., BTC for Bitcoin).

- Quantity – How many units of the asset have you sold?

- Dates – The date you acquired the asset and the date you sold it.

- Cost Basis (maybe) – For some transactions, the broker may also report what you originally paid for the asset. This helps calculate your gain or loss.

Note: Whether or not cost basis is reported depends on whether the asset is considered “covered” under IRS rules. For now, it’s optional in 2025, but will be required in 2026 for certain assets.

Why It Matters

This new form is part of a broader move by the IRS to bring more transparency to digital asset activity.

For investors, Form 1099-DA helps simplify tax filing by summarizing your digital asset sales. For brokers, it introduces a formal reporting structure, making digital asset transactions more consistent with how stocks and bonds are tracked.

In short, it's a shift toward treating crypto and NFTs with the same seriousness as other financial investments.

Final Thoughts

Form 1099-DA marks a turning point for digital assets in the U.S. tax system. It signals that crypto is no longer a fringe activity; it’s part of the mainstream economy now.

If you buy or sell digital assets, keep good records. And if you're a broker, start preparing your systems to handle this new requirement.

Tax season may not be fun, but with tools like 1099-DA, it’s getting a little more organized.